The Haitians “leaving South Florida and other places in the United States so abruptly would cause great economic damage to the United States,” Archbishop Thomas Wenski said.

The Haitians “leaving South Florida and other places in the United States so abruptly would cause great economic damage to the United States,” Archbishop Thomas Wenski said.

A seemingly serene landscape of gas and dust is hopping with star formation behind the scenes.

Read More

A bright reflection nebula shares the stage with a protostar and planet-forming disk in this Hubble image.

Read More

Jan 18, 2026 / 10:26 am (CNA).

This past week, nearly a quarter of U.S. states sued the federal government for defining biological sex as binary, the U.S. Supreme Court heard arguments for and against legally allowing males to compete against females in sports, and a Vatican official called surrogacy a “new form of colonialism” that commodifies women and their children.

These are just the latest legal and cultural effects of a “mass cultural confusion” surrounding the meaning and purpose of the human body, and particularly women’s bodies, according to Leah Jacobson, program coordinator of the Catholic Women’s and Gender Studies Program at the University of St. Thomas in Houston.

On Jan. 9–10, the program sponsored a symposium titled “The Beauty of Truth: Navigating Society Today as a Catholic Woman,” which brought together a group of Catholic women who have used their gifts of intellect and faith to serve as what Jacobson calls an “antidote” to the “chaos and confusion” of the cultural moment.

The speakers presented on a wide range of topics concerned with the beauty, truth, and necessity of the Church’s teachings on human sexuality, while also acknowledging how difficult living according to those teachings can sometimes be.

In one of the first talks, writer Mary Eberstadt argued that the question “Who am I?” became harder to answer due to the widespread use of the birth control pill, which has led to huge increases in abortion, divorce, fatherlessness, single parenthood, and childlessness.

“Each of these acts is an act of human subtraction,” Eberstadt said. “I’m not trying to make a point about morality, but arithmetic.”

“The number of people we can call our own” became smaller, she said.

While she acknowledged that not everyone has been affected equally, “members of our species share a collective environment. Just as toxic waste affects everyone," she said, the reduction in the number of human connections “amounts to a massive disturbance to the human ecosystem,” leading to a crisis of human identity.

This reduction in the number of people in an individual's life, she argued, resulted in widespread confusion over gender identity and the meaning and purpose of the body.

Eberstadt also attributed the decline in religiosity to the smaller number of human connections modern people have.

“The sexual revolution subtracted the number of role models,” she said. “Many children have no siblings, no cousins, no aunts or uncles, no father; yet that is how humans conduct social learning.”

“Without children, adults are less likely to go to church,” she said. “Without birth, we lose knowledge of the transcendent. Without an earthly father, it is hard to grasp the paradigm of a heavenly father.”

“Living without God is not liberating people,” she continued. “It’s tearing some individuals apart, making people miserable and lonely.”

When the sexual revolution made sex "recreational and not procreative, what it produced above all is a love deficit,” Eberstadt said.

At the same time, secularization produced “troubled, disconnected souls drifting through society without gravity, shattering the ability to answer ‘Who am I?’”

“The Church is the answer to the love deficit because Church teachings about who we are and what we’re here for are true,” she said.

She concluded with a final note on hope, saying “it is easy to feel embattled, but we must never lose sight of the faces of the sexual revolution’s victims,” she said, “who are sending up primal screams for a world more ordered than many of today’s people now know; more ordered to mercy, to community and redemption.”

Erika Bachiochi, a legal scholar and fellow at the Ethics and Public Policy Center who has taught a class for the graduate program, shared her experience as a mother of seven who tried to live according to the Church’s “difficult” teachings.

As her children began to arrive at “a breakneck pace” and each pregnancy was “a bit of a crucible,” Bachiochi said being a mother was “very hard” for her, partly due to wounds from her youth (among other troubles, her own mother had been married and divorced three times), and partly because of a lack of community.

Echoing Eberstadt’s “arithmetic” problem, Bachiochi described having very few examples of Catholic family life and a very small support system.

Bachiochi said she believes God heals us from our wounds through our “particular vocations,” however.

Of motherhood, she said: “I think God really healed me through being faithful to teachings that I found quite hard, but truly beautiful. I was intellectually convinced by them and found them spiritually beautiful, but found them to be very, very hard to live.”

“Motherhood has served to heal me profoundly," she said, encouraging young mothers to have faith that though it might be difficult now, there is an “amazing future” awaiting them.

“It’s really an incredible gift that Church has given me … the gift of obedience,” she said.

She also said by God’s grace, she was given an “excellent husband” and has found that “just as the Church promises, that leaning into motherhood, into the little things, the daily needs, the constant requests for my attention, has truly been a school of virtue.”

The Catholic Women’s and Gender Studies Program is a new part of the Nesti Center for Faith and Culture at the University of St. Thomas, a recognized Catholic cultural center of the Vatican’s Dicastery for Culture and Education.

Read More

Jan 13, 2026 / 15:36 pm (CNA).

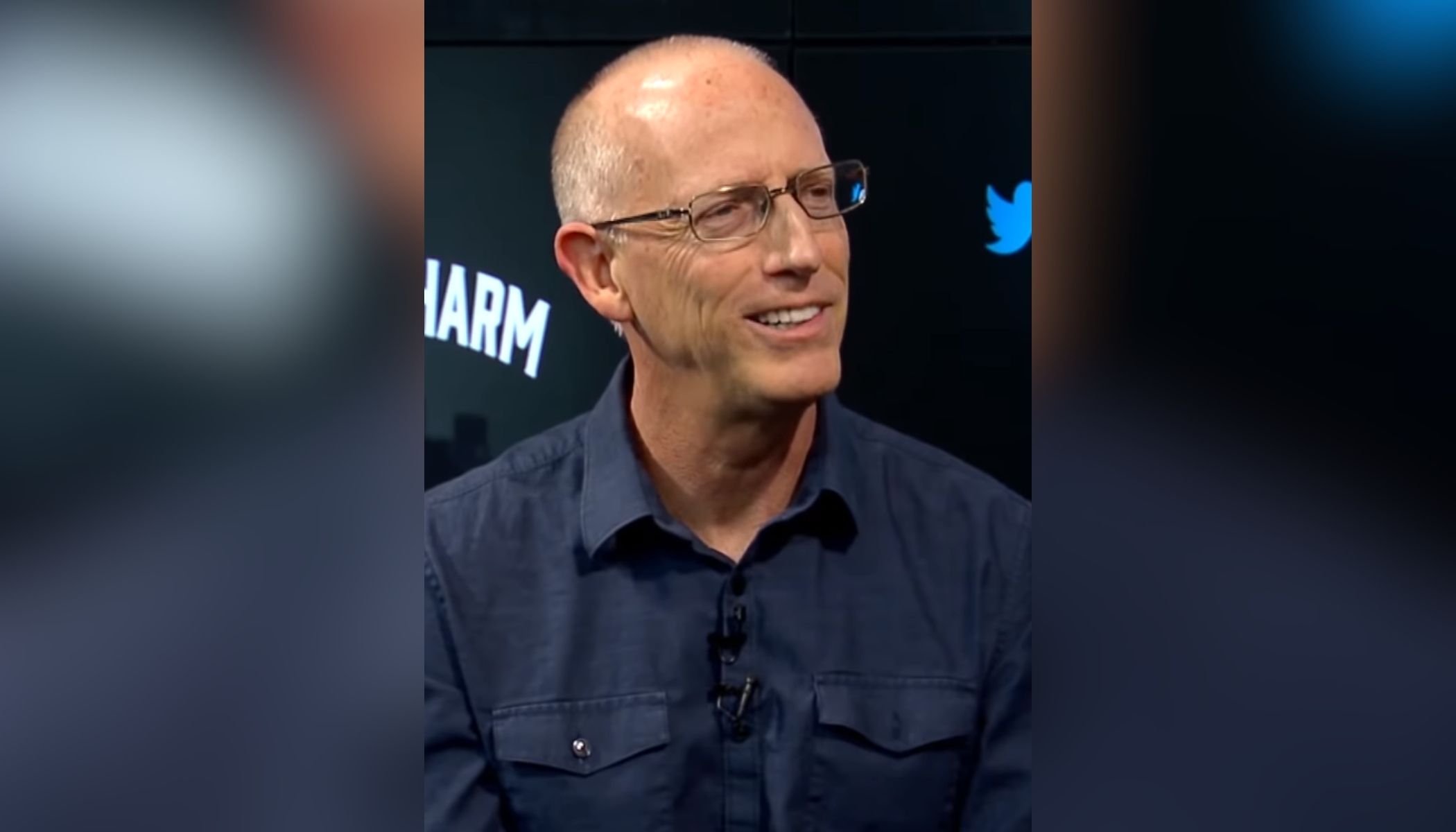

Scott Adams, the creator of the long-running “Dilbert” comic strip whose art satirized the typical American workplace, died on Jan. 13 at 68 years old after a battle with cancer.

Adams, who became known later in his career for espousing conservative and at times controversial political views, revealed in May 2025 that he was suffering from prostate cancer. The disease spread in the coming months, with Adams passing away after a short stay in hospice.

On Jan. 13, shortly after his death, Adams’ X account posted a “final message” from the renowned cartoonist in which he recalled that many of his Christian friends had urged him to convert to Christianity.

A Final Message From Scott Adams pic.twitter.com/QKX6b0MFZA

— Scott Adams (@ScottAdamsSays) January 13, 2026

“I accept Jesus Christ as my lord and savior, and I look forward to spending an eternity with him,” Adams declared in the message, adding that he hoped he was “still qualified for entry” into heaven upon his death.

“I had an amazing life. I gave it everything I had,” he wrote in the statement. “If you got any benefits from my work, I’m asking you to pay it forward as best you can. That is the legacy I want.”

Adams had previously announced his intent to convert on Jan. 1, admitting that “any skepticism I have about reality would certainly be instantly answered if I wake up in heaven.”

Born June 8, 1957, in Windham, New York, Adams began drawing from a young age. His work at the Pacific Bell Telephone Company in the 1980s and 1990s inspired many of the humorous office stereotypes portrayed in “Dilbert.”

A send-up of many of the tropes that continue to define U.S. office work, “Dilbert” became wildly popular into the 2000s and eventually included a brief television series.

Later in his career he launched the video talk series “Real Coffee With Scott Adams,” which he continued until just several days before his death.

In his final message released after his death, Adams told his fans: “Be useful.”

“And please know,” he added, “I loved you all to the end.”

Read More![Trump urges Republican ‘flexibility’ on taxpayer-funded abortions #Catholic

President Donald Trump talks to Republicans about their stance on the Hyde Amendment on Jan. 6, 2026. | Credit: Mandel NGAN/AFP via Getty Images

Jan 6, 2026 / 18:10 pm (CNA).

President Donald Trump is asking congressional Republicans to be more flexible on taxpayer funding for abortions as lawmakers continue to negotiate an extension to health care subsidies related to the Affordable Care Act, also known as Obamacare.Some federal subsidies that lowered premiums for those enrolled in the Affordable Care Act expired in December. The Kaiser Family Foundation estimates that the average increase to premiums for people who lost the subsidies will be about 114%, from $888 in 2025 to $1,904 in 2026. The exact costs will be different, depending on specific plans.Trump has encouraged his party to work on extending those subsidies and is asking them to be “flexible” on a provision that could affect tax-funded abortion. Democrats have proposed ending the restrictions of the Hyde Amendment, which bans direct federal funding for abortions in most cases.“Let the money go directly to the people,” Trump said at the House Republican Conference retreat at the John F. Kennedy Center for the Performing Arts on Jan. 6.“Now you have to be a little flexible on Hyde,” the president said. “You know that you got to be a little flexible. You got to work something [out]. You got to use ingenuity. You got to work. We’re all big fans of everything, but you got to be flexible. You have to have flexibility.”The Hyde Amendment began as a bipartisan provision in funding bills that prohibited the use of federal funds for more than 45 years. Lawmakers have reauthorized the prohibition every year since it was first introduced in 1976.A study from the Charlotte Lozier Institute estimates that the Hyde Amendment has saved more than 2.6 million lives. According to a poll conducted by the Marist Institute for Public Opinion, which was commissioned by the Knights of Columbus, nearly 6 in 10 Americans oppose tax funding for abortions.However, in recent years, many Democratic politicians have tried to keep the rule out of spending bills. Former President Joe Biden abandoned the Hyde Amendment in budget proposals, but it was ultimately included in the final compromise versions that became law.Marjorie Dannenfelser, president of Susan B. Anthony Pro-Life America, criticized Trump for urging flexibility on the provision, calling its support “an unshakeable bedrock principle and a minimum standard in the Republican Party.”Dannenfelser said Republicans “are sure to lose this November” if they abandon Hyde: “The voters sent a [Republican] trifecta to Washington and they expect it to govern like one.”“Giving in to Democrat demands that our tax dollars are used to fund plans that cover abortion on demand until birth would be a massive betrayal,” she said.Dannenfelser also noted that, before these comments, Trump has consistently supported the Hyde Amendment. The president issued an executive order in January on enforcing the Hyde Amendment that accused Biden’s administration of disregarding this “commonsense policy.”“For nearly five decades, the Congress has annually enacted the Hyde Amendment and similar laws that prevent federal funding of elective abortion, reflecting a long-standing consensus that American taxpayers should not be forced to pay for that practice,” the executive order reads.“It is the policy of the United States, consistent with the Hyde Amendment, to end the forced use of federal taxpayer dollars to fund or promote elective abortion,” it adds.](https://unitedyam.com/wp-content/uploads/2026/01/trump-urges-republican-flexibility-on-taxpayer-funded-abortions-catholic-president-donald-trump-talks-to-republicans-about-their-stance-on-the-hyde-amendment-on-jan-6-2026.jpg)

Jan 6, 2026 / 18:10 pm (CNA).

President Donald Trump is asking congressional Republicans to be more flexible on taxpayer funding for abortions as lawmakers continue to negotiate an extension to health care subsidies related to the Affordable Care Act, also known as Obamacare.

Some federal subsidies that lowered premiums for those enrolled in the Affordable Care Act expired in December.

The Kaiser Family Foundation estimates that the average increase to premiums for people who lost the subsidies will be about 114%, from $888 in 2025 to $1,904 in 2026. The exact costs will be different, depending on specific plans.

Trump has encouraged his party to work on extending those subsidies and is asking them to be “flexible” on a provision that could affect tax-funded abortion. Democrats have proposed ending the restrictions of the Hyde Amendment, which bans direct federal funding for abortions in most cases.

“Let the money go directly to the people,” Trump said at the House Republican Conference retreat at the John F. Kennedy Center for the Performing Arts on Jan. 6.

“Now you have to be a little flexible on Hyde,” the president said. “You know that you got to be a little flexible. You got to work something [out]. You got to use ingenuity. You got to work. We’re all big fans of everything, but you got to be flexible. You have to have flexibility.”

The Hyde Amendment began as a bipartisan provision in funding bills that prohibited the use of federal funds for more than 45 years. Lawmakers have reauthorized the prohibition every year since it was first introduced in 1976.

A study from the Charlotte Lozier Institute estimates that the Hyde Amendment has saved more than 2.6 million lives. According to a poll conducted by the Marist Institute for Public Opinion, which was commissioned by the Knights of Columbus, nearly 6 in 10 Americans oppose tax funding for abortions.

However, in recent years, many Democratic politicians have tried to keep the rule out of spending bills. Former President Joe Biden abandoned the Hyde Amendment in budget proposals, but it was ultimately included in the final compromise versions that became law.

Marjorie Dannenfelser, president of Susan B. Anthony Pro-Life America, criticized Trump for urging flexibility on the provision, calling its support “an unshakeable bedrock principle and a minimum standard in the Republican Party.”

Dannenfelser said Republicans “are sure to lose this November” if they abandon Hyde: “The voters sent a [Republican] trifecta to Washington and they expect it to govern like one.”

“Giving in to Democrat demands that our tax dollars are used to fund plans that cover abortion on demand until birth would be a massive betrayal,” she said.

Dannenfelser also noted that, before these comments, Trump has consistently supported the Hyde Amendment. The president issued an executive order in January on enforcing the Hyde Amendment that accused Biden’s administration of disregarding this “commonsense policy.”

“For nearly five decades, the Congress has annually enacted the Hyde Amendment and similar laws that prevent federal funding of elective abortion, reflecting a long-standing consensus that American taxpayers should not be forced to pay for that practice,” the executive order reads.

“It is the policy of the United States, consistent with the Hyde Amendment, to end the forced use of federal taxpayer dollars to fund or promote elective abortion,” it adds.

Read More![Food assistance, housing top Catholic Charities’ policy wish list in 2026 #Catholic

Credit: Jonathan Weiss/Shutterstock

Jan 2, 2026 / 07:00 am (CNA).

Many people who receive assistance through anti-poverty programs faced disruptions in 2025, and Catholic Charities’ wish list for 2026 includes government support for food assistance and housing.The largest disruption came in October when food stamps received through the Supplemental Nutrition Assistance Program (SNAP) were delayed amid the government shutdown. Funding for rental and heating assistance were also disrupted.Confusion about how to implement a memo in January from the Office of Management and Budget calling for a grant freeze also caused delays in funding related to health care, housing affordability, and food assistance.Luz Tavarez, vice president of government relations at Catholic Charities USA, said “people get nervous and scared” amid disruptions.Many Catholic Charities affiliates saw an influx in clients, especially during the shutdown, but Tavarez said there are “very poor people who rely on SNAP subsidies for their meals” and who “can’t get to a Catholic Charities [affiliate] or other food pantry for assistance” when it happens.Long-term eligibility and funding changes to SNAP were also approved in the tax overhaul signed into law in July. Previous rules only included a work requirement up to age 54, but the law extended those requirements up to age 64. It added stricter and more frequent checks for verifying the work requirements.It also shifted some funding responsibilities away from the federal government and to the states.Tavarez expressed concern about some of the SNAP changes as well, saying the government should end “burdensome requirements for individuals and states.”Under the new law, there are stricter rules for verifying a person’s immigration status for benefits. It also limited which noncitizens could receive SNAP benefits, which excluded some refugees and people granted asylum. Tavarez expressed concern about such SNAP changes, encouraging the government to permit “humanitarian-based noncitizens” to receive those benefits.Overall the 2025 tax law gave the biggest boost to the richest families while poorer families might get a little less help than before, according to the Congressional Budget Office.The bill added a work requirement for Medicaid recipients, and this will not take effect until 2027. Under the previous law, there was no work requirement for this benefit. It also shifts some Medicaid funding requirements onto the states.Tavarez said Catholic Charities has “concerns with how [work requirements are] implemented” moving forward but does not oppose the idea outright: “There’s dignity in work so the Church isn’t necessarily opposed to people working as long as there’s some opportunities for people to do other things and other issues are taken into consideration.”She also expressed concerns about funding shifts: “We know that not every state views things like SNAP and Medicaid as a good thing. We don’t know how states are going to balance their budget and prioritize these programs.”2026 wish listLooking forward to 2026, Tavarez said Catholic Charities hopes the government will restore full funding to the Temporary Emergency Food Assistance Program for food banks and bulk food distribution programs and ensure that funding is protected for school meals and the Special Supplemental Nutrition Program for Women, Infants, and Children.The Department of Housing and Urban Development (HUD) made policy changes in November that would focus its homelessness funding on “transitional” housing instead of “permanent” housing. This move is facing legal challenges.President Donald Trump’s administration initially sought to cut federal housing assistance and shift much of those costs to states, but this was ultimately not included in the final version of the 2025 tax law.In December, Trump promised an “aggressive” housing reform plan that focuses on reducing costs. At this time, the specifics of that proposal have not been announced. The increased cost to buy a new home has outpaced the growth in wages for decades.Tavarez said Catholic Charities is focused on housing affordability in 2026 and that the solution must be multifaceted. This includes “building and developing affordable housing,” “a tax credit for developers,” “more affordable housing units,” and subsidies and Section 8 vouchers for low-income Americans, she said.“We recognize that there’s a real crisis — I think everybody does in a bipartisan way — but there needs to be a real bipartisan approach and it’s going to require money,” Tavarez said.Tax credits and economic trendsSome changes to the tax code included in the 2025 tax law are geared toward helping low-income Americans.Specifically, the law reduced taxes taken from tips and overtime work. It also increased the child tax credit from $2,000 to $2,200 and tied the credit to inflation, meaning that it will increase each year based on the rate of inflation.Tavarez characterized the changes to the child tax credit as a “win” and hopes it can be expanded further.The economy has been a mixed bag, with November unemployment numbers showing a 4.6% rate. In November of last year, it was slightly lower at 4.2%.Inflation has gone down a little, with the annual rate being around 2.7%. In 2024, it was around 2.9%. The average wage for workers also outpaced inflation, with hourly wages increasing by 3.5%, which shows a modest inflation-adjusted increase of 0.8%.](https://unitedyam.com/wp-content/uploads/2026/01/food-assistance-housing-top-catholic-charities-policy-wish-list-in-2026-catholic-credit-jonathan-weiss-shutterstockjan-2-2026-0700-am-cna-many-people-who-receive-assistance-th-1.jpg)

Jan 2, 2026 / 07:00 am (CNA).

Many people who receive assistance through anti-poverty programs faced disruptions in 2025, and Catholic Charities’ wish list for 2026 includes government support for food assistance and housing.

The largest disruption came in October when food stamps received through the Supplemental Nutrition Assistance Program (SNAP) were delayed amid the government shutdown. Funding for rental and heating assistance were also disrupted.

Confusion about how to implement a memo in January from the Office of Management and Budget calling for a grant freeze also caused delays in funding related to health care, housing affordability, and food assistance.

Luz Tavarez, vice president of government relations at Catholic Charities USA, said “people get nervous and scared” amid disruptions.

Many Catholic Charities affiliates saw an influx in clients, especially during the shutdown, but Tavarez said there are “very poor people who rely on SNAP subsidies for their meals” and who “can’t get to a Catholic Charities [affiliate] or other food pantry for assistance” when it happens.

Long-term eligibility and funding changes to SNAP were also approved in the tax overhaul signed into law in July. Previous rules only included a work requirement up to age 54, but the law extended those requirements up to age 64. It added stricter and more frequent checks for verifying the work requirements.

It also shifted some funding responsibilities away from the federal government and to the states.

Tavarez expressed concern about some of the SNAP changes as well, saying the government should end “burdensome requirements for individuals and states.”

Under the new law, there are stricter rules for verifying a person’s immigration status for benefits. It also limited which noncitizens could receive SNAP benefits, which excluded some refugees and people granted asylum.

Tavarez expressed concern about such SNAP changes, encouraging the government to permit “humanitarian-based noncitizens” to receive those benefits.

Overall the 2025 tax law gave the biggest boost to the richest families while poorer families might get a little less help than before, according to the Congressional Budget Office.

The bill added a work requirement for Medicaid recipients, and this will not take effect until 2027. Under the previous law, there was no work requirement for this benefit. It also shifts some Medicaid funding requirements onto the states.

Tavarez said Catholic Charities has “concerns with how [work requirements are] implemented” moving forward but does not oppose the idea outright: “There’s dignity in work so the Church isn’t necessarily opposed to people working as long as there’s some opportunities for people to do other things and other issues are taken into consideration.”

She also expressed concerns about funding shifts: “We know that not every state views things like SNAP and Medicaid as a good thing. We don’t know how states are going to balance their budget and prioritize these programs.”

Looking forward to 2026, Tavarez said Catholic Charities hopes the government will restore full funding to the Temporary Emergency Food Assistance Program for food banks and bulk food distribution programs and ensure that funding is protected for school meals and the Special Supplemental Nutrition Program for Women, Infants, and Children.

The Department of Housing and Urban Development (HUD) made policy changes in November that would focus its homelessness funding on “transitional” housing instead of “permanent” housing. This move is facing legal challenges.

President Donald Trump’s administration initially sought to cut federal housing assistance and shift much of those costs to states, but this was ultimately not included in the final version of the 2025 tax law.

In December, Trump promised an “aggressive” housing reform plan that focuses on reducing costs. At this time, the specifics of that proposal have not been announced. The increased cost to buy a new home has outpaced the growth in wages for decades.

Tavarez said Catholic Charities is focused on housing affordability in 2026 and that the solution must be multifaceted. This includes “building and developing affordable housing,” “a tax credit for developers,” “more affordable housing units,” and subsidies and Section 8 vouchers for low-income Americans, she said.

“We recognize that there’s a real crisis — I think everybody does in a bipartisan way — but there needs to be a real bipartisan approach and it’s going to require money,” Tavarez said.

Some changes to the tax code included in the 2025 tax law are geared toward helping low-income Americans.

Specifically, the law reduced taxes taken from tips and overtime work. It also increased the child tax credit from $2,000 to $2,200 and tied the credit to inflation, meaning that it will increase each year based on the rate of inflation.

Tavarez characterized the changes to the child tax credit as a “win” and hopes it can be expanded further.

The economy has been a mixed bag, with November unemployment numbers showing a 4.6% rate. In November of last year, it was slightly lower at 4.2%.

Inflation has gone down a little, with the annual rate being around 2.7%. In 2024, it was around 2.9%. The average wage for workers also outpaced inflation, with hourly wages increasing by 3.5%, which shows a modest inflation-adjusted increase of 0.8%.

Read More

The asteroid Donaldjohanson as seen by the Lucy Long-Range Reconnaissance Imager (L’LORRI). This is one of the most detailed images returned by NASA’s Lucy spacecraft during its flyby. This image was taken at 1:51 p.m. EDT (17:51 UTC), April 20, 2025, near closest approach, from a range of approximately 660 miles (1,100 km). The spacecraft’s closest approach distance was 600 miles (960 km), but the image shown was taken approximately 40 seconds beforehand. The image has been sharpened and processed to enhance contrast.

Read More

This plaque commemorating the STS-107 space shuttle Columbia crew looks over the Mars landscape after the Mars Exploration Rover, Spirit, landed and deployed onto the red planet on Jan. 4, 2004. The plaque, mounted on the high-gain antenna, is shown while the rover underwent final checkout March 28, 2003, in the Payload Hazardous Servicing Facility at NASA’s Kennedy Space Center in Florida.

Read More

Engineers with NASA’s Exploration Ground Systems complete stacking operations on the twin SLS (Space Launch System) solid rocket boosters for Artemis II by integrating the nose cones atop the forward assemblies inside the Vehicle Assembly Building’s High Bay 3 at NASA’s Kennedy Space Center in Florida on Wednesday, Feb. 19, 2025. The twin solid boosters will help support the remaining rocket components and the Orion spacecraft during final assembly of the Artemis II Moon rocket and provide more than 75 percent of the total SLS thrust during liftoff from NASA Kennedy’s Launch Pad 39B.

Read More