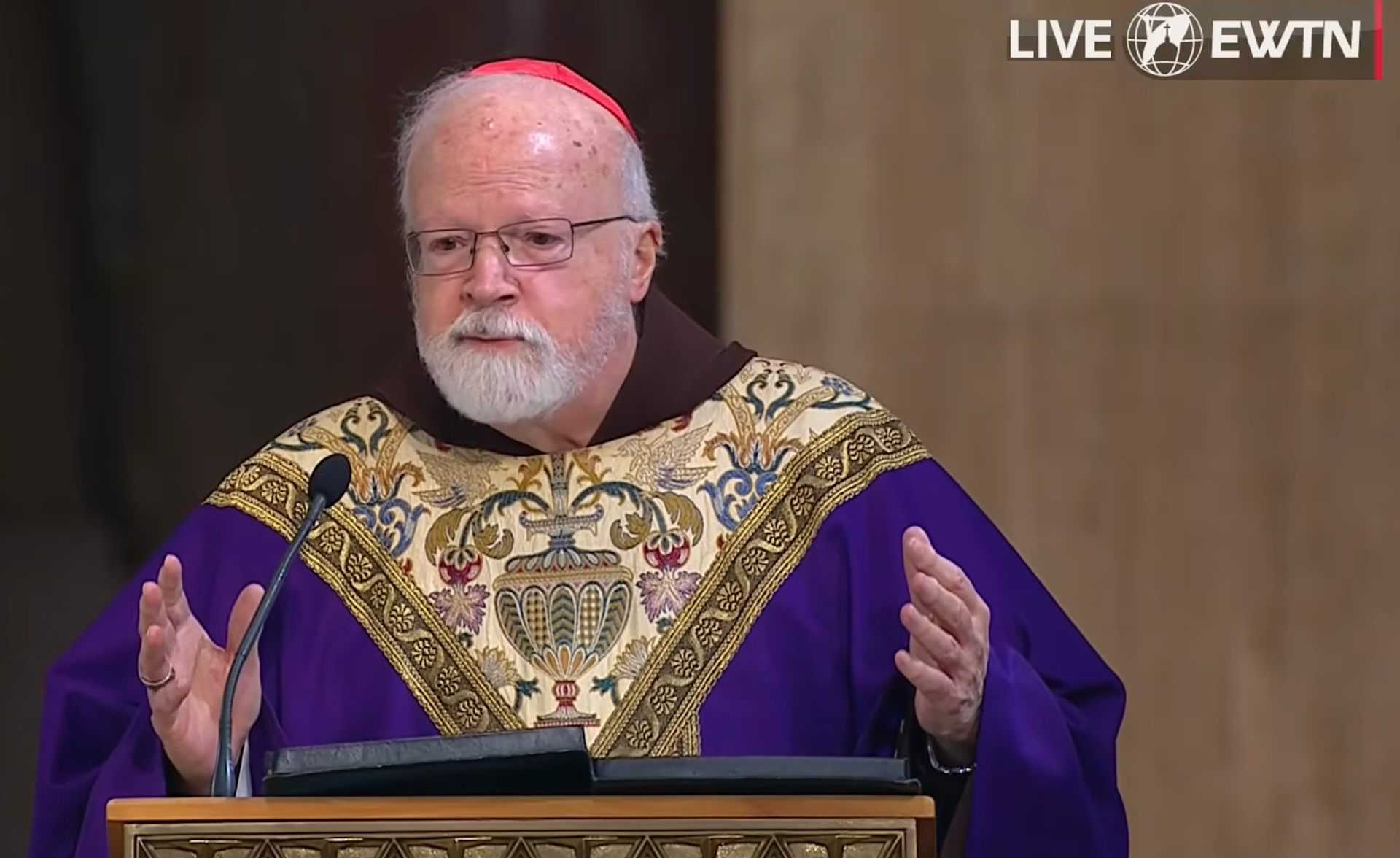

Young Catholics gather for a possibly record-breaking large speed dating event in Columbus, Ohio, on Jan. 4, 2026. | Credit: Gigi Duncan/EWTN News / null

Young Catholics gather for a possibly record-breaking large speed dating event in Columbus, Ohio, on Jan. 4, 2026. | Credit: Gigi Duncan/EWTN News / null

Jan 5, 2026 / 16:41 pm (CNA).

“Do you believe in miracles, or should we start with coffee?”

Young Catholics gathered for a possibly record-breaking large speed dating event in Columbus, Ohio, on Jan. 4.

About 2,500 students participated in speed dating at SEEK 2026, reflecting both a thirst for genuine connection and a willingness to step outside of comfort zones in pursuit of meaningful relationships. At a time when dating culture often seems dominated by casual hookups, social media pressures, and uncertainty, SEEK 2026 participants explored a wide range of topics, from personal faith to vocational discernment.

The event broke the world record for the largest speed dating event based on earlier entries in Guinness World Records.

About 26,000 people attended the SEEK 2026 conference held simultaneously in Columbus, Denver, and Fort Worth, Texas, organized by FOCUS, a Catholic group that sends missionaries to college campuses and parishes.

In Columbus, which drew about 16,000 attendees, Emily Wilson, a Catholic author and YouTuber, offered students a framework for approaching dating with clarity and purpose ahead of the speed dating event on Jan. 4.

6 principles for intentional Catholic dating

Wilson emphasized six key points for navigating dating with freedom, dignity, and an ultimate focus on God.

1. Go on one date — and let others do the same.

“Dating is the process of discernment,” Wilson said. “You do not need to know if you’re going to marry someone before saying yes to a second date. Jesus wants you to be calm.” The idea is simple: Allow yourself and others to explore relationships without pressure, gossip, or unrealistic expectations.

2. Use the word “date” and be clear and intentional.

Clarity matters, especially in an age where sending a “WYD” (what are you doing?) text has become common. “If you want to stand out, be clear. Use the word ‘date,’” Wilson told the audience. “Call her. Say, ‘I’d love to take you on a date.’ Yes, it’s a risk, but many marriages begin with that courage.”

3. If God calls you to marriage, college is not the only place to meet your spouse.

Wilson encouraged young people to resist the “ring by spring” pressures. “Focus on becoming the most beautiful version of yourself — the person God is calling you to be right now,” she said. God’s timing, she emphasized, is unique for everyone.

4. Let go of the idea that your future spouse will perfectly match your type.

While attraction is important, deeper qualities matter most. “When life gets hard,” Wilson noted, one will not be so fixated on physical appearance but rather be thanking God that their spouse is so “selfless, giving, kind, loving, virtuous, and holy.”

5. Guard your heart.

“Peace in dating comes from making hard choices to protect your heart,” she said, quoting Philippians 4:7: “The peace of God, which surpasses all understanding, will guard your hearts and minds in Christ Jesus.” Making intentional decisions is a form of self-respect, not aggression.

6. Do not apologize for your standards.

Wilson urged students to stand firm in their faith and virtues: “Say it with confidence. ‘I’m looking for a virtuous Catholic who loves the Eucharist, desires the sacraments, and wants a faithful marriage.’ There is nothing to apologize for.”

Breaking records, building connections

The “Catholic Speed Dating Event with Candid” drew lines stretching across several exhibit halls down the Greater Columbus Convention Center. Students repeatedly noted that such spaces provide rare, faith-aligned opportunities to meet new people without immediate expectation.

Participants described the speed dating event as both countercultural and reassuring — a response to frustrations many feel with modern dating. For Clemson University student Jonathan Brinker, the shared Catholic identity immediately changed the tone of conversations. “It was nice to meet people who have similar values,” he said. “That makes the conversation deeper and more meaningful.”

That sense of ease stood out for Shippensburg University student Joseph Striggle as well. “Events like this help you realize dating isn’t as intimidating as it’s made out to be,” he said. “It’s just having a normal conversation with another person.”

His classmate, Tom Gehman, said the event addressed deeper concerns about today’s dating culture. “A lot of people don’t share the same worldview or end goals, especially when it comes to faith and relationships,” he noted. “People want reassurance that there are other people who share their values.”

Expressing a strong dislike of social media, Gehman added that he desires “to meet someone face-to-face and ask them out directly,” calling the event “good practice” for doing so.

Students from Western Kentucky University echoed this sentiment as well as an emphasis on lowering pressure while remaining intentional. “Going on a first date doesn’t mean you have to marry that person,” Mary Pikar said. “It’s just about getting to know each other.”

Karley Solorzano added that high expectations can sometimes lead to inaction. “We overthink dating, especially as Catholics,” she said. “Events like this can give us a way to take chances and trust that God can surprise us.”

For some students, simply being surrounded by others who take faith seriously was encouraging. Seton Hall University student Emily Castillo said observing faithful behavior — even in her male friendships — gave her hope. “Seeing that makes me think what it could be like with someone who genuinely loves and cares for me,” she said.

Maria Notario added: “A shared faith allows relationships to go deeper than surface-level connections. Everyone [at the event] is single and Catholic; there’s at least some foundation there.”

Short conversations also proved meaningful. Kylee Jackels from Winona State University said having a designated space to meet people — even for a few minutes at a time — mattered. “It’s valuable to have a low-pressure environment where people can actually talk,” she said.

“There aren’t many single Christians where I’m from,” Lindsay Moen added. “It was nice to be in this space with similar people without crazy expectations.” The two students did see immediate results, however, as their friend was asked out on a date while waiting in line for the event to begin.

Others said the event helped them step outside their comfort zones. Anna Whittenburg of Bowling Green State University referenced Emily Wilson’s earlier point of maintaining standards, sharing that this was something she kept in mind before going into the speed dating event.

“Hearing that reaffirmed by someone like Emily Wilson made a difference. I don’t have to apologize for wanting a good, healthy Catholic relationship,” she said. Her twin sister, Elaina, added that the experience was practical as well as affirming: “It was a good way to practice talking to new people.”

For University of Alabama student Jay Zito, this event challenged initial hesitation. “We were kind of dragged into it by a friend,” he admitted. “But I’m glad we were. In an age where men can be fearful of approaching women for several reasons, this space gave people permission to try and make meaningful connections.”

His friend Landon McClellan added that the in-person nature of the event was crucial. “Hookup culture is everywhere today, and things like social media, filters, and AI mess with expectations and confidence,” he said. “Dating doesn’t have to be scary; it can be a really good thing that will lead to sacramental marriages.”

Candid Dating, a platform co-founded by Taylor O’Brien, led the speed dating event. Candid hosts weekly virtual speed dating for Catholic singles, and SEEK provided a chance to create real connections in person.

“Success can look different for everyone. For some, it’s gaining experience and confidence in talking to others — men or women,” O’Brien said. “For others, it might be building the courage to ask for someone’s number or feeling secure and confident present themselves as a whole person.”

She added that another goal for some could be marriage, reflecting the previous year’s several couples who have since become engaged.

Hope for the future

Wilson said the weekend confirmed what she has seen in her work with Catholic singles: a deep desire for holy, intentional relationships.

“There has been a real breakdown in communication, and a lot of fear has crept in,” she said. That fear, she described, is not from the Lord but rather the enemy who “wants us stuck in panic or overwhelm” so that we don’t “step into what the Lord desires for us.”

Drawing on her experience with Sacred Spark, a Catholic dating platform she co-founded, Wilson expressed optimism. “We now have tens of thousands of Catholic singles on the app who are intentionally seeking meaningful relationships, even if it starts digitally — just making that initial connection.”

She added that in the coming years, “we’re going to see a revival of beautiful sacramental marriages, with Catholic singles who are intentional, communicative, open, honest, and clear.”

“After things have become as complicated as they have, there’s really nowhere to go but up,” she said. “For these young Catholics desiring relationships, I really stand on hope.”

Read More

![CUA professor launches AI marketplace in line with Catholic social teaching #Catholic

Credit: David Gyung/Shutterstock

Jan 17, 2026 / 06:00 am (CNA).

An artificial intelligence (AI) marketplace launched by a business professor at The Catholic University of America seeks to offer products and services in a venue consistent with the social teachings of the Catholic Church — it is called Almma AI.Lucas Wall, who teaches finance at the university and has led several entrepreneurial ventures, began building Almma AI in mid-2023. The marketplace facilitates transactions for AI-related products, allowing people to upload their creations to be purchased or, in some cases, used for no charge.The types of products that can be offered on the marketplace include Large Language Models (LLMs) — similar to ChatGPT and Grok — along with AI prompts, personas, assistants, agents, and plugins.Although other marketplaces exist, Wall told EWTN News that Almma AI is designed to ensure the average person can “benefit from this new revolution that is coming” by selling or purchasing products in the marketplace.“With most technological revolutions and changes, there are only a handful of people who make fortunes,” Wall said.Almma’s mission statement is “AI profits for all,” and Wall said it is meant to “help people monetize their knowledge.” He said the marketplace can “build bridges across cultures” because people anywhere can access it, and “allows people to make solutions for their neighbors or for their parishes.”Almma does not exclusively offer Catholic-related products, but it does block the sale of anything that is immoral or could provoke sin, which Wall said was another major contrast with other AI marketplaces.“I want to be part of the group of people who help innovation meet morality,” he said.Among the examples of problems within larger AI companies, he noted, are the development of artificial romantic chatbots and the creation of erotica and artificial pornographic images and videos. He also expressed concern about AI consultation in end-of-life care.“I refuse to believe we don’t have enough imagination as a Catholic community and the courage to build something better,” Wall said.AI and Catholic social teachingWall said the development of Almma AI was “responding to the call of Pope Francis that he very clearly outlined in [the 2025 doctrinal note] Antiqua et Nova” and also took inspiration from Pope Leo XIII’s 1891 encyclical Rerum Novarum.In Antiqua et Nova, the Vatican holds that the development of AI should spur us to “a renewed appreciation of all that is human.” It teaches that AI should be used to serve the common good, promote human development, and not simply be used for individual or corporate gain.That note builds on the framework provided in Rerum Novarum, which expressed Catholic social teaching in the wake of the industrial revolution. At the time, Pope Leo XIII emphasized a need to seek the common good and safeguard the dignity of work when many laborers faced poor working conditions.“Wages ought not to be insufficient to support a frugal and well-behaved wage-earner,” Leo XIII writes. “... If a workman’s wages be sufficient to enable him comfortably to support himself, his wife, and his children, he will find it easy, if he be a sensible man, to practice thrift, and he will not fail, by cutting down expenses, to put by some little savings and thus secure a modest source of income.”Wall said Almma AI follows those guidelines by “trying to help people earn a decent living and keeping their dignity.” He added: “If you want to monetize a skill, we have the tools for you.”When the current pontiff Leo XIV chose the name “Leo,” he said he did so to honor Leo XIII, who “addressed the social question in the context of the first great industrial revolution.” He chose the name, in part, because AI developments pose “new challenges for the defense of human dignity, justice, and labor,” Leo XIV explained.Leo XIV has spoken at length about AI. This includes warnings about anti-human ideologies, the threat to human connections and interactions, and concern about the displacement of workers. However, he has also highlighted the potential benefits of AI if used to advance humanity and uphold the dignity of the human person.Wall welcomed continued guidance from the Vatican, saying the Church has “moral foundations … beyond what anyone in secular society can point at.” He expressed hope that Leo XIV will author a document similar to Rerum Novarum that addresses the changes AI is bringing about to the global economy“I pray daily for it,” Wall said.](https://unitedyam.com/wp-content/uploads/2026/01/cua-professor-launches-ai-marketplace-in-line-with-catholic-social-teaching-catholic-credit-david-gyung-shutterstockjan-17-2026-0600-am-cna-an-artificial-intelligence-ai-marketplace-l.jpg)

![Catholic singles seek faithful connections at huge SEEK 2026 speed dating event #Catholic

Young Catholics gather for a possibly record-breaking large speed dating event in Columbus, Ohio, on Jan. 4, 2026. | Credit: Gigi Duncan/EWTN News / null

Jan 5, 2026 / 16:41 pm (CNA).

“Do you believe in miracles, or should we start with coffee?”Young Catholics gathered for a possibly record-breaking large speed dating event in Columbus, Ohio, on Jan. 4. About 2,500 students participated in speed dating at SEEK 2026, reflecting both a thirst for genuine connection and a willingness to step outside of comfort zones in pursuit of meaningful relationships. At a time when dating culture often seems dominated by casual hookups, social media pressures, and uncertainty, SEEK 2026 participants explored a wide range of topics, from personal faith to vocational discernment. The event broke the world record for the largest speed dating event based on earlier entries in Guinness World Records.About 26,000 people attended the SEEK 2026 conference held simultaneously in Columbus, Denver, and Fort Worth, Texas, organized by FOCUS, a Catholic group that sends missionaries to college campuses and parishes.In Columbus, which drew about 16,000 attendees, Emily Wilson, a Catholic author and YouTuber, offered students a framework for approaching dating with clarity and purpose ahead of the speed dating event on Jan. 4. 6 principles for intentional Catholic dating Wilson emphasized six key points for navigating dating with freedom, dignity, and an ultimate focus on God.1. Go on one date — and let others do the same.“Dating is the process of discernment,” Wilson said. “You do not need to know if you’re going to marry someone before saying yes to a second date. Jesus wants you to be calm.” The idea is simple: Allow yourself and others to explore relationships without pressure, gossip, or unrealistic expectations. 2. Use the word “date” and be clear and intentional.Clarity matters, especially in an age where sending a “WYD” (what are you doing?) text has become common. “If you want to stand out, be clear. Use the word ‘date,’” Wilson told the audience. “Call her. Say, ‘I’d love to take you on a date.’ Yes, it’s a risk, but many marriages begin with that courage.”3. If God calls you to marriage, college is not the only place to meet your spouse.Wilson encouraged young people to resist the “ring by spring” pressures. “Focus on becoming the most beautiful version of yourself — the person God is calling you to be right now,” she said. God’s timing, she emphasized, is unique for everyone.4. Let go of the idea that your future spouse will perfectly match your type.While attraction is important, deeper qualities matter most. “When life gets hard,” Wilson noted, one will not be so fixated on physical appearance but rather be thanking God that their spouse is so “selfless, giving, kind, loving, virtuous, and holy.”5. Guard your heart.“Peace in dating comes from making hard choices to protect your heart,” she said, quoting Philippians 4:7: “The peace of God, which surpasses all understanding, will guard your hearts and minds in Christ Jesus.” Making intentional decisions is a form of self-respect, not aggression.6. Do not apologize for your standards.Wilson urged students to stand firm in their faith and virtues: “Say it with confidence. ‘I’m looking for a virtuous Catholic who loves the Eucharist, desires the sacraments, and wants a faithful marriage.’ There is nothing to apologize for.”Breaking records, building connectionsThe “Catholic Speed Dating Event with Candid” drew lines stretching across several exhibit halls down the Greater Columbus Convention Center. Students repeatedly noted that such spaces provide rare, faith-aligned opportunities to meet new people without immediate expectation.Participants described the speed dating event as both countercultural and reassuring — a response to frustrations many feel with modern dating. For Clemson University student Jonathan Brinker, the shared Catholic identity immediately changed the tone of conversations. “It was nice to meet people who have similar values,” he said. “That makes the conversation deeper and more meaningful.”That sense of ease stood out for Shippensburg University student Joseph Striggle as well. “Events like this help you realize dating isn’t as intimidating as it’s made out to be,” he said. “It’s just having a normal conversation with another person.”His classmate, Tom Gehman, said the event addressed deeper concerns about today’s dating culture. “A lot of people don’t share the same worldview or end goals, especially when it comes to faith and relationships,” he noted. “People want reassurance that there are other people who share their values.” Expressing a strong dislike of social media, Gehman added that he desires “to meet someone face-to-face and ask them out directly,” calling the event “good practice” for doing so.Students from Western Kentucky University echoed this sentiment as well as an emphasis on lowering pressure while remaining intentional. “Going on a first date doesn’t mean you have to marry that person,” Mary Pikar said. “It’s just about getting to know each other.” Karley Solorzano added that high expectations can sometimes lead to inaction. “We overthink dating, especially as Catholics,” she said. “Events like this can give us a way to take chances and trust that God can surprise us.”For some students, simply being surrounded by others who take faith seriously was encouraging. Seton Hall University student Emily Castillo said observing faithful behavior — even in her male friendships — gave her hope. “Seeing that makes me think what it could be like with someone who genuinely loves and cares for me,” she said. Maria Notario added: “A shared faith allows relationships to go deeper than surface-level connections. Everyone [at the event] is single and Catholic; there’s at least some foundation there.”Short conversations also proved meaningful. Kylee Jackels from Winona State University said having a designated space to meet people — even for a few minutes at a time — mattered. “It’s valuable to have a low-pressure environment where people can actually talk,” she said. “There aren’t many single Christians where I’m from,” Lindsay Moen added. “It was nice to be in this space with similar people without crazy expectations.” The two students did see immediate results, however, as their friend was asked out on a date while waiting in line for the event to begin.Others said the event helped them step outside their comfort zones. Anna Whittenburg of Bowling Green State University referenced Emily Wilson’s earlier point of maintaining standards, sharing that this was something she kept in mind before going into the speed dating event. “Hearing that reaffirmed by someone like Emily Wilson made a difference. I don’t have to apologize for wanting a good, healthy Catholic relationship,” she said. Her twin sister, Elaina, added that the experience was practical as well as affirming: “It was a good way to practice talking to new people.”For University of Alabama student Jay Zito, this event challenged initial hesitation. “We were kind of dragged into it by a friend,” he admitted. “But I’m glad we were. In an age where men can be fearful of approaching women for several reasons, this space gave people permission to try and make meaningful connections.” His friend Landon McClellan added that the in-person nature of the event was crucial. “Hookup culture is everywhere today, and things like social media, filters, and AI mess with expectations and confidence,” he said. “Dating doesn’t have to be scary; it can be a really good thing that will lead to sacramental marriages.”Candid Dating, a platform co-founded by Taylor O’Brien, led the speed dating event. Candid hosts weekly virtual speed dating for Catholic singles, and SEEK provided a chance to create real connections in person. “Success can look different for everyone. For some, it’s gaining experience and confidence in talking to others — men or women,” O’Brien said. “For others, it might be building the courage to ask for someone’s number or feeling secure and confident present themselves as a whole person.”She added that another goal for some could be marriage, reflecting the previous year’s several couples who have since become engaged. Hope for the futureWilson said the weekend confirmed what she has seen in her work with Catholic singles: a deep desire for holy, intentional relationships. “There has been a real breakdown in communication, and a lot of fear has crept in,” she said. That fear, she described, is not from the Lord but rather the enemy who “wants us stuck in panic or overwhelm” so that we don’t “step into what the Lord desires for us.”Drawing on her experience with Sacred Spark, a Catholic dating platform she co-founded, Wilson expressed optimism. “We now have tens of thousands of Catholic singles on the app who are intentionally seeking meaningful relationships, even if it starts digitally — just making that initial connection.”She added that in the coming years, “we’re going to see a revival of beautiful sacramental marriages, with Catholic singles who are intentional, communicative, open, honest, and clear.”“After things have become as complicated as they have, there’s really nowhere to go but up,” she said. “For these young Catholics desiring relationships, I really stand on hope.”](https://unitedyam.com/wp-content/uploads/2026/01/catholic-singles-seek-faithful-connections-at-huge-seek-2026-speed-dating-event-catholic-young-catholics-gather-for-a-possibly-record-breaking-large-speed-dating-event-in-columbus-ohio-on-jan-scaled.jpg)

![Food assistance, housing top Catholic Charities’ policy wish list in 2026 #Catholic

Credit: Jonathan Weiss/Shutterstock

Jan 2, 2026 / 07:00 am (CNA).

Many people who receive assistance through anti-poverty programs faced disruptions in 2025, and Catholic Charities’ wish list for 2026 includes government support for food assistance and housing.The largest disruption came in October when food stamps received through the Supplemental Nutrition Assistance Program (SNAP) were delayed amid the government shutdown. Funding for rental and heating assistance were also disrupted.Confusion about how to implement a memo in January from the Office of Management and Budget calling for a grant freeze also caused delays in funding related to health care, housing affordability, and food assistance.Luz Tavarez, vice president of government relations at Catholic Charities USA, said “people get nervous and scared” amid disruptions.Many Catholic Charities affiliates saw an influx in clients, especially during the shutdown, but Tavarez said there are “very poor people who rely on SNAP subsidies for their meals” and who “can’t get to a Catholic Charities [affiliate] or other food pantry for assistance” when it happens.Long-term eligibility and funding changes to SNAP were also approved in the tax overhaul signed into law in July. Previous rules only included a work requirement up to age 54, but the law extended those requirements up to age 64. It added stricter and more frequent checks for verifying the work requirements.It also shifted some funding responsibilities away from the federal government and to the states.Tavarez expressed concern about some of the SNAP changes as well, saying the government should end “burdensome requirements for individuals and states.”Under the new law, there are stricter rules for verifying a person’s immigration status for benefits. It also limited which noncitizens could receive SNAP benefits, which excluded some refugees and people granted asylum. Tavarez expressed concern about such SNAP changes, encouraging the government to permit “humanitarian-based noncitizens” to receive those benefits.Overall the 2025 tax law gave the biggest boost to the richest families while poorer families might get a little less help than before, according to the Congressional Budget Office.The bill added a work requirement for Medicaid recipients, and this will not take effect until 2027. Under the previous law, there was no work requirement for this benefit. It also shifts some Medicaid funding requirements onto the states.Tavarez said Catholic Charities has “concerns with how [work requirements are] implemented” moving forward but does not oppose the idea outright: “There’s dignity in work so the Church isn’t necessarily opposed to people working as long as there’s some opportunities for people to do other things and other issues are taken into consideration.”She also expressed concerns about funding shifts: “We know that not every state views things like SNAP and Medicaid as a good thing. We don’t know how states are going to balance their budget and prioritize these programs.”2026 wish listLooking forward to 2026, Tavarez said Catholic Charities hopes the government will restore full funding to the Temporary Emergency Food Assistance Program for food banks and bulk food distribution programs and ensure that funding is protected for school meals and the Special Supplemental Nutrition Program for Women, Infants, and Children.The Department of Housing and Urban Development (HUD) made policy changes in November that would focus its homelessness funding on “transitional” housing instead of “permanent” housing. This move is facing legal challenges.President Donald Trump’s administration initially sought to cut federal housing assistance and shift much of those costs to states, but this was ultimately not included in the final version of the 2025 tax law.In December, Trump promised an “aggressive” housing reform plan that focuses on reducing costs. At this time, the specifics of that proposal have not been announced. The increased cost to buy a new home has outpaced the growth in wages for decades.Tavarez said Catholic Charities is focused on housing affordability in 2026 and that the solution must be multifaceted. This includes “building and developing affordable housing,” “a tax credit for developers,” “more affordable housing units,” and subsidies and Section 8 vouchers for low-income Americans, she said.“We recognize that there’s a real crisis — I think everybody does in a bipartisan way — but there needs to be a real bipartisan approach and it’s going to require money,” Tavarez said.Tax credits and economic trendsSome changes to the tax code included in the 2025 tax law are geared toward helping low-income Americans.Specifically, the law reduced taxes taken from tips and overtime work. It also increased the child tax credit from $2,000 to $2,200 and tied the credit to inflation, meaning that it will increase each year based on the rate of inflation.Tavarez characterized the changes to the child tax credit as a “win” and hopes it can be expanded further.The economy has been a mixed bag, with November unemployment numbers showing a 4.6% rate. In November of last year, it was slightly lower at 4.2%.Inflation has gone down a little, with the annual rate being around 2.7%. In 2024, it was around 2.9%. The average wage for workers also outpaced inflation, with hourly wages increasing by 3.5%, which shows a modest inflation-adjusted increase of 0.8%.](https://unitedyam.com/wp-content/uploads/2026/01/food-assistance-housing-top-catholic-charities-policy-wish-list-in-2026-catholic-credit-jonathan-weiss-shutterstockjan-2-2026-0700-am-cna-many-people-who-receive-assistance-th-1.jpg)

![Bishop of Columbus grants Mass dispensation to immigrants who fear deportation #Catholic

Bishop Earl Fernandes of Columbus, Ohio, carries the Blessed Sacrament during a procession at Pickaway Correctional Institution on June 28, 2024, at one of the stops on the Seton Route of the National Eucharistic Pilgrimage. Credit: Catholic Times/Ken Snow

Dec 29, 2025 / 14:18 pm (CNA).

The bishop of the Diocese of Columbus, Ohio, has granted a dispensation from Mass for parishioners who fear deportation by immigration enforcement officers, who have increased activity in the area since mid-December.Bishop Earl Fernandes announced in a letter and video last week that those who fear immigration enforcement action are free from the obligation to attend Sunday Mass until Jan. 11, 2026. The bishop said the dispensation was precipitated by increased immigration enforcement activity in Ohio stemming from Operation Buckeye, a U.S. Immigration and Customs Enforcement (ICE) initiative launched Dec. 16 that is allegedly targeting “the worst of the worst criminal illegal aliens in Columbus and throughout Ohio.”Fernandes told EWTN News on Monday that after he began receiving messages from pastors throughout his diocese informing him that Hispanic parishioners were afraid to attend Mass due to the increased enforcement by ICE officers, he asked diocesan personnel in the Office of Catholic Social Doctrine and the Hispanic ministry office to help him get a clearer picture of “what is happening on the ground.”“They told me there were ICE trucks in front of parishes; even in front of schools,” Fernandes said. “All of a sudden, there were half or fewer attendees at the Posadas [traditional pre-Christmas] celebrations.”He said he decided to issue the dispensation “even though I did not want to” because “people need Mass and the sacraments more than ever” and he wanted families to be together without fear for Christmas.During a Mass he celebrated on Saturday, Dec. 20, Fernandes told EWTN News the pastor of the church remained at the front door and saw an ICE truck nearby. Because of this, the Posada [traditional pre-Christmas] procession was moved from outdoors to a hallway inside the building because “the people were too afraid to go outside.”The procession took place inside the building. “We had a meal, there was a piñata and some celebrations,” Fernandes said. “But it was clear there were a lot of people who weren’t there.”The bishop said he began receiving calls from pastors more than two hours from Columbus who were reporting ICE’s presence.Sharp drops in Mass attendance“The atmosphere of fear was keeping people away,” he said. One pastor reported that only one-third of his congregation attended weekend Mass. Another said only one-quarter were present, Fernandes said.Of the increased enforcement against immigrants, Fernandes reflected: “It’s easy to say immigrants should have come to our country legally. But what if your parents came here illegally and you are a U.S. citizen? … What if one spouse is documented and the other is not. What’s in the best interest of their children and society at large?”Of the Mexican population in Columbus, Fernandes said that “many are the grandchildren of the Cristeros,” resistors to the Mexican government’s attempts in the 1920s to suppress Catholicism in the country.He said a large group of Hispanics came to the midnight Mass on Christmas at the cathedral because they did not think ICE would be there. “I think they felt safe at the cathedral.”Fernandes said the Diocese of Columbus also has large numbers of Catholic African migrants who have “tons of children” and make up “young communities full of life and full of faith.”Fernandes said he talked to the pastor of a multiethnic parish made up of Nigerians, Filipinos, and others, and “they’re afraid too.”He is concerned for the Haitian community as well, whose temporary protected status (TPS) is set to expire on Feb. 3, 2026.He said the Mass dispensation expires on Jan. 11, the end of the Christmas season, at which time he will reevaluate the situation.](https://unitedyam.com/wp-content/uploads/2026/01/bishop-of-columbus-grants-mass-dispensation-to-immigrants-who-fear-deportation-catholic-bishop-earl-fernandes-of-columbus-ohio-carries-the-blessed-sacrament-during-a-procession-at-pickaway-corr-scaled.jpg)